Digital Asset Infrastructure for FinTechs and Neobanks

Enterprise-grade crypto infrastructure for stablecoins, bitcoin, and a full range of digital assets - all through one API.

Built for Every Fintech Use Case

From neobanks to remittance apps, our flexible infrastructure adapts to your specific business model and user needs.

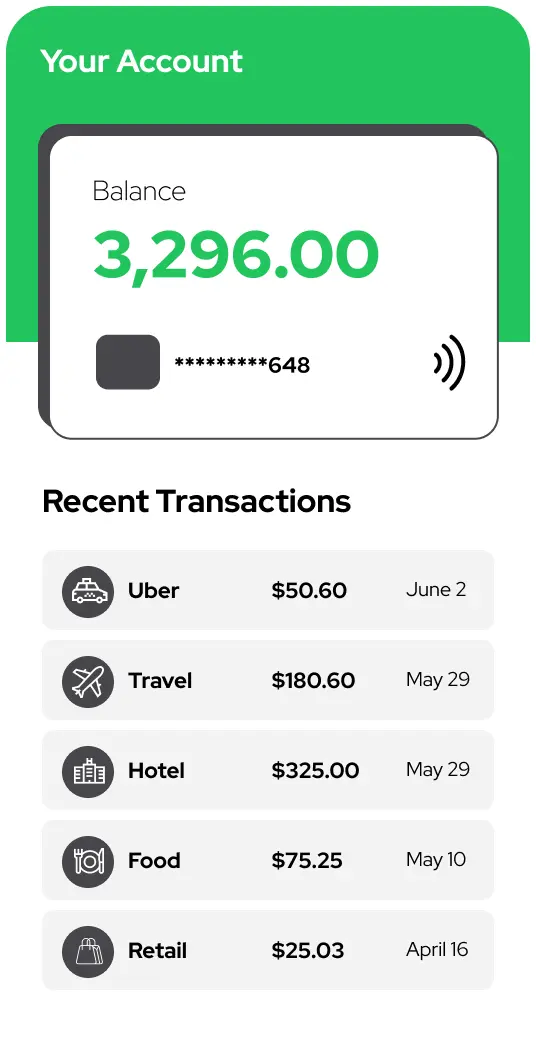

Neobanks

Add crypto buying, selling, and custody to your app with seamless integration and zero infrastructure.

Neobanks

Modern banking customers expect crypto. Give them the ability to buy, sell, and hold digital assets directly in your app without building backend infrastructure or hiring compliance teams. Leverage your existing KYC while we handle custody, transaction monitoring, and regulatory reporting so you can focus on delivering the experience your customers want.

Digital Wallets

Give users native fiat-to-crypto on-ramps and off-ramps without building your own rails or managing compliance.

Digital Wallets

Let users seamlessly move between fiat and crypto inside your wallet with instant ACH, card, and cash support. Our API integrates with your existing KYC and handles fraud prevention, liquidity, and settlement while you maintain full control over branding and user experience.

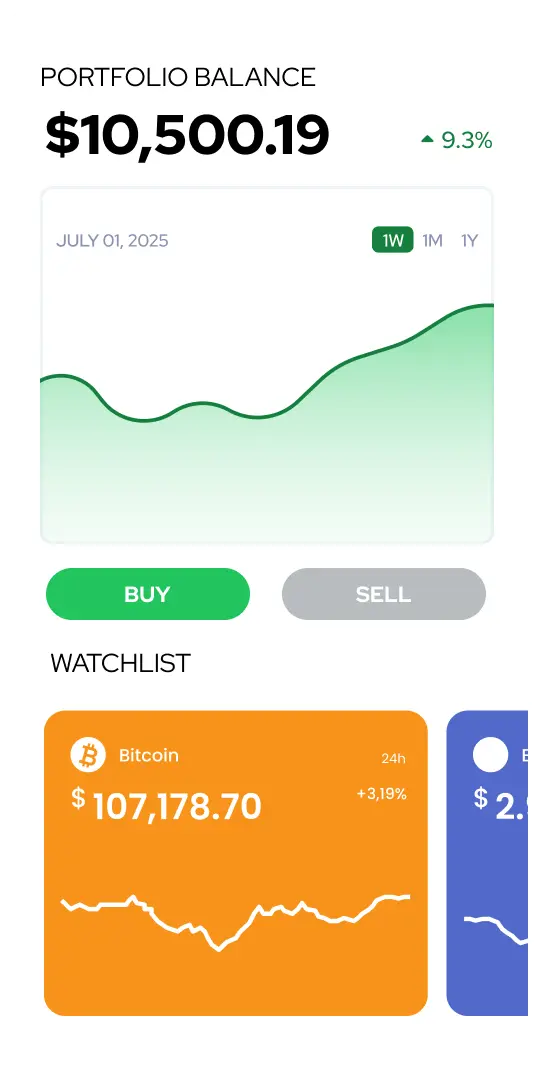

Investing Platforms

Offer crypto as an investable asset alongside stocks and bonds with full regulatory coverage and custody.

Investing Platforms

Expand your investment offerings with Bitcoin, Ethereum, and other digital assets. Our infrastructure provides secure custody, real-time pricing, instant execution, and complete transaction reporting. Use your existing KYC processes while we handle crypto compliance and security complexity. Give your users diversified portfolios without the regulatory burden.

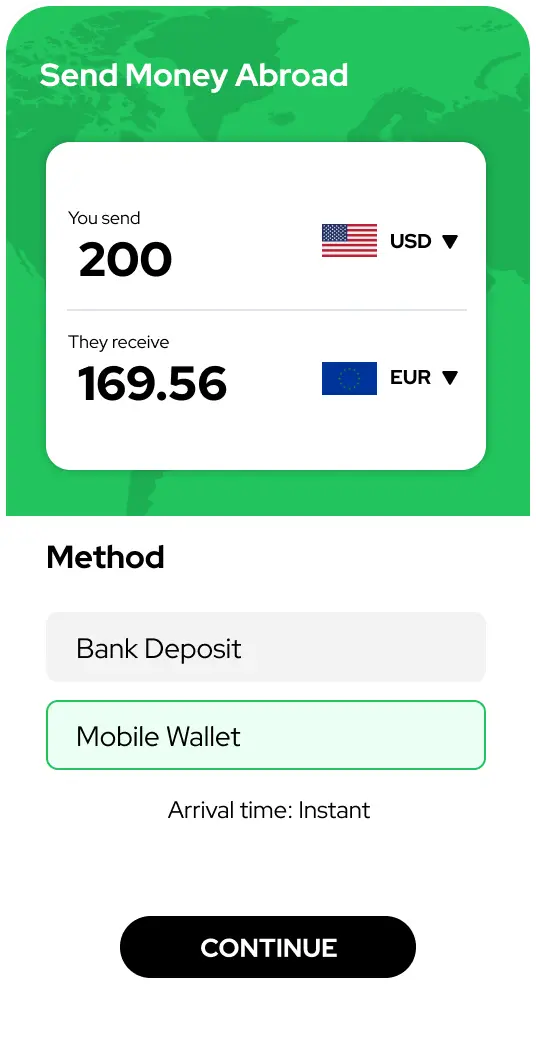

Remittance Apps

Enable instant, low-cost cross-border transfers using stablecoins while we handle compliance and settlement.

Remittance Apps

Transform international money movement with stablecoin rails that settle in minutes instead of days. Reduce transfer costs by up to 90% while maintaining full AML compliance across jurisdictions. Leverage your existing KYC infrastructure while our platform manages crypto liquidity, local currency conversion, and regulatory requirements so you can offer faster, cheaper remittances.

Payroll platforms

Let employees receive wages in crypto with automated conversion and built-in tax reporting.

Payroll platforms

Attract top talent by offering crypto-denominated payroll options. Employees choose their preferred split between fiat and crypto, and our platform handles instant conversion, wallet delivery, and 1099 reporting. Provide a great customer experience while we manage the technical and regulatory complexity of crypto payouts.

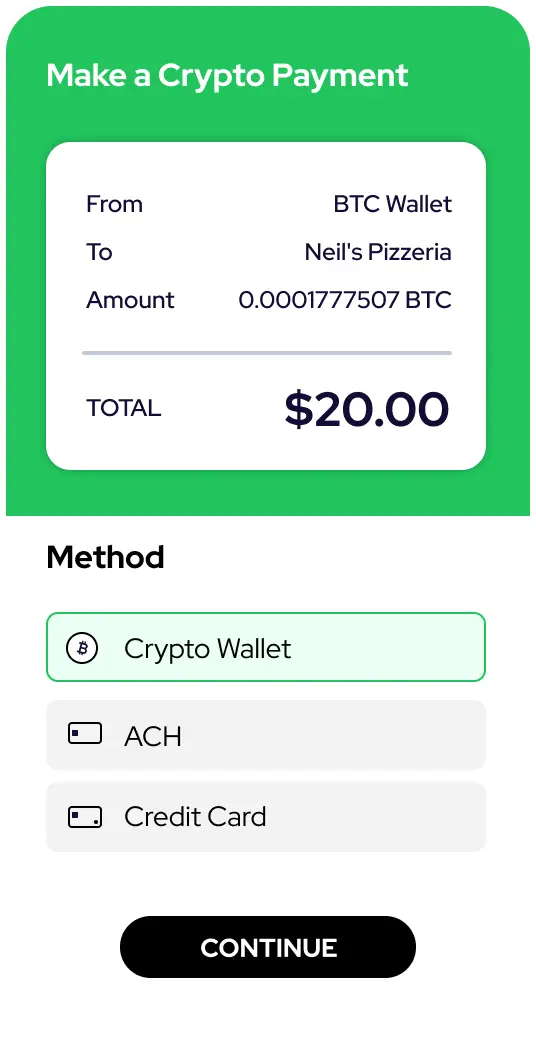

PoS merchants

Accept crypto payments at checkout with instant fiat settlement, no volatility risk or crypto expertise required.

PoS merchants

Enable Bitcoin and stablecoin payments at your point of sale with guaranteed fiat conversion at the time of transaction. Your merchants receive dollars in their bank account while customers pay with crypto. We eliminate volatility risk, manage crypto wallets, and handle all compliance so your merchants can accept the future of payments today.

Launch Crypto Services Without Building From Scratch

Crypto Conversion and Settlement

Enable seamless fiat ↔ crypto transactions behind the scenes. We handle the execution, liquidity sourcing, and crypto delivery so funds are settled quickly and securely to your users' wallets.

Realtime quotes

Get accurate, real-time pricing for crypto buy and sell transactions. Our quote API ensures your users see locked-in rates before they confirm a trade.

Transaction History

Give users a clear record of their crypto activity — including what they bought or sold, when, and the fees paid. Delivered via API for easy display in your app.

Custody

Store assets securely with Coinme custody or deliver directly to users’ non-custodial wallets.

Adding crypto shouldn’t cost millions and

years of development

Offering crypto is no longer optional, but building the infrastructure yourself is slow, expensive, and risky.

Between licensing, compliance, custody, and liquidity, it’s a full-time operation.

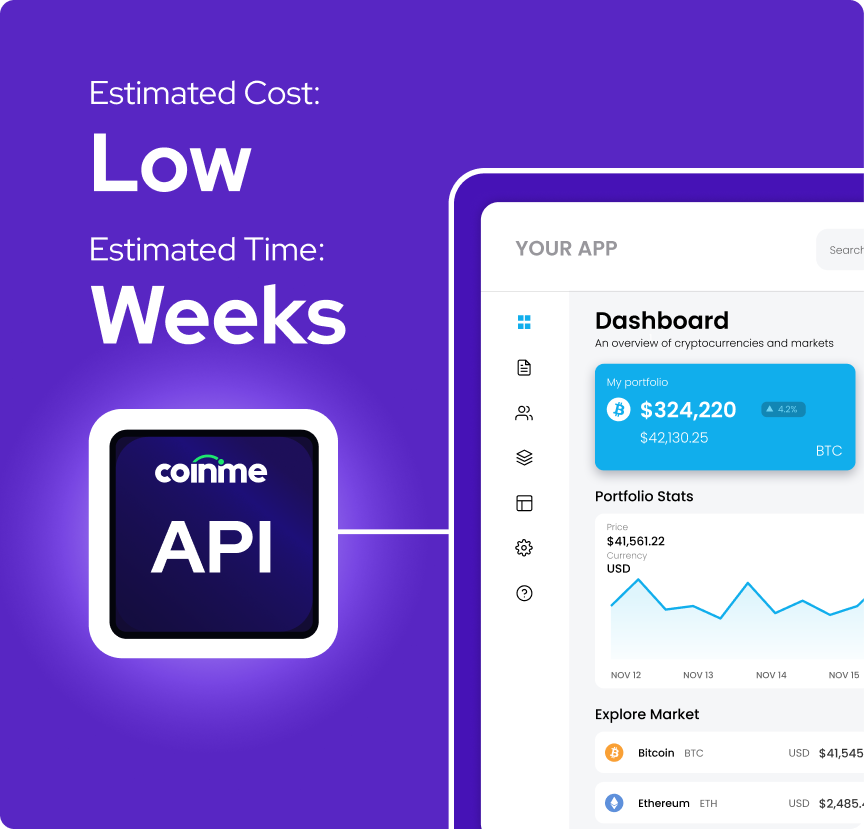

Avoid costly in-house builds

Integrate with Coinme's simple API

Unlock new revenue streams for your FinTech platform

When users leave your app to buy crypto elsewhere, you lose revenue, trust, and long-term engagement. With Coinme, you can own the full crypto experience inside your product and monetize where you want.

Why Choose Coinme?

We've built the crypto infrastructure so you don't have to. Focus on what matters most - your users and your business growth.

Fully Customizable

White-label solutions that match your brand perfectly. From UI components to API responses, everything can be tailored to create a seamless user experience that feels native to your platform.

Fast Time to Market

Launch crypto features in weeks, not months. Our pre-built modules and streamlined integration process get you to market 10x faster than building from scratch, giving you a competitive advantage.

Plug & Play APIs

RESTful APIs designed for developer happiness. Clean documentation, SDK libraries in multiple languages, and webhook support make integration effortless for your development team.

Dedicated Support

Get hands-on support from our partner success team, from integration to launch and beyond. We work closely with your technical and operations teams to ensure a smooth rollout, fast response times, and long-term success as your crypto offering grows.

Get up and running in 3 steps

Talk to our team

See if we’re a fit for your product

Start integration

Get API keys, docs, and sandbox access

Launch

Go live with crypto features in weeks

Talk to our team

See if we’re a fit for your product

Start integration

Get API keys, docs, and sandbox access

Launch

Go live with crypto features in weeks

Frequently Asked Questions

What alternatives are there to Coinme’s custody and liquidity solution?

Alternatives to Coinme’s crypto custody and liquidity API usually mean working with multiple vendors. For example, one provider might handle custody, another manages liquidity, and a third covers KYC or AML.

Coinme simplifies all of that by combining custody, liquidity, compliance, and licensing into a single Crypto-as-a-Service (CaaS) platform. This reduces vendor management and shortens integration time while ensuring everything is fully licensed and compliant across the U.S.

What is the pricing for Coinme’s services and how is it structured?

Coinme’s enterprise crypto payments API uses a flexible, volume-based pricing model instead of fixed fees.

Partners work with Coinme to design a plan that fits their integration and transaction volume while keeping end-user costs low. Pricing depends on factors such as whether you’re offering cash on/off-ramps, stablecoin payments, or custody.

How does Coinme’s custody solution compare to others?

Coinme’s regulated custody solution is designed for flexibility and scalability. It lets fintechs and banks offer crypto and stablecoin trading directly in their own branded app while Coinme handles KYC, custody, and liquidity behind the scenes.

Unlike large institutional custodians, Coinme also supports cash onramps at thousands of U.S. retail locations, something competitors typically don’t offer.

How can a crypto-as-a-service API help brands add buy/sell and custody features inside their apps?

A Crypto-as-a-Service (CaaS) API lets brands embed crypto buying, selling, and custody directly in their app without building infrastructure from scratch.

With Coinme’s API, companies can offer fiat-to-crypto and stablecoin conversions, KYC/AML verification, and secure custody all in one integration.

This approach helps fintechs and wallets launch crypto and stablecoin features faster while staying fully compliant.

What are the best crypto custody and liquidity solutions for embedded wallet onramps?

The best crypto custody and liquidity APIs offer deep liquidity, secure custody, and simple integration for wallets and fintech apps.

Coinme's API enables real-time fiat-to-crypto and stablecoin conversion with access to institutional liquidity for competitive pricing. It also provides flexible custody options so assets can be held securely or transferred to non-custodial wallets based on your integration.

With built-in KYC, compliance, and on/off-ramp coverage, Coinme makes it easy for fintechs to offer crypto without adding complexity.

In short: Coinme combines custody, liquidity, and compliance into a single API that powers a complete embedded wallet experience.

How should fintech brands choose a crypto custody and liquidity provider for their app?

When choosing a crypto custody and liquidity provider, fintech brands should focus on:

- Regulatory compliance: Ensure the provider is compliant in the jurisdiction they operate in.

- Seamless integration: Look for APIs that keep users inside your app for KYC and trading.

- All-in-one capabilities: Choose a platform that handles KYC, custody, and liquidity together to simplify your stack.

- Security and flexibility: Verify that the provider supports both custodial and non-custodial wallets.

- Integration support: Look for strong documentation, predictable APIs, and real-time webhooks.

Coinme's CaaS platform checks all of these boxes, giving partners a compliant, fully integrated crypto experience from onboarding through liquidity management.

How do you integrate a custody/liquidity API to power a crypto wallet experience for users?

Integrating a custody and liquidity API into your wallet can be done in a few straightforward steps.

- Add user onboarding: Verify users in-app to stay compliant with KYC and AML requirements.

- Connect fiat-to-crypto endpoints: Use the API to get a quote and execute buy or sell orders in real time.

- Set up custody or transfers: After the purchase, crypto can be held securely or sent to a non-custodial wallet, depending on your setup.

Coinme’s developer-friendly API includes clear documentation, sandbox environments, and webhook support to make integration smooth and reliable.

Which crypto API providers include KYC, custody, and on-chain liquidity all in one?

Only a few providers combine KYC, custody, and liquidity into a single integration, and Coinme is one of them.

Coinme’s Crypto-as-a-Service platform offers:

- KYC/AML onboarding for user verification

- Secure custody of digital assets

- Deep liquidity access for real-time trading

This all-in-one setup removes the need to manage multiple vendors. Coinme’s API gives fintechs, wallets, and remittance apps turnkey digital asset infrastructure with built-in compliance and U.S. licensing.

Labs is acquiring Coinme to power the Open Money Stack.

Labs is acquiring Coinme to power the Open Money Stack.